Long Term: Survivor’s Benefit

SURVIVOR’S BENEFIT

The Survivors’ Benefit can be paid as either a monthly Pension or as a one-time Grant to the widow/widower, child(ren) or parents of a deceased Insured Person whose death was not caused by a work-related injury.

The monthly Pension or one-time Grant paid is determined based on the deceased Insured Person’s overall contributions.

Persons who may not qualify for a monthly Pension may still be eligible to receive a one-time Grant. Qualifying conditions apply.

HOW TO QUALIFY

| YOU MUST | REQUIREMENTS |

|---|---|

| Be a surviving widow/widower, child or parent of a deceased Insured Person, who was receiving or was entitled to receive Retirement or Invalidity Benefit. | Submit completed claim form for Survivors’ Benefit (SVB1), signed and dated by the claimant. |

| WIDOW, a woman who has lost her spouse by death, must: – Be married or living in common-law relationship with deceased Insured Person for five (5) years or more – Have care of deceased Insured Person’s children; or – Be pregnant for deceased Insured Person; – Be 50 years or older to qualify for a pension for life; If younger than 50 years, other conditions may apply. | Present Social Security card or birth certificate of all survivor(s): widow/widower, child(ren) or parent(s) claiming the benefit. |

| WIDOWER, a man who has lost his spouse by death, must: – Be permanently incapable of self-support and was wholly dependent on the deceased – Be married or living in common-law relationship with deceased Insured Person for five (5) years or more. | Present death certificate of deceased Insured Person signed and dated by a registered doctor in Belize. |

| CHILDREN – Includes biological, stepchildren or adopted children of the deceased Insured Person. – Under 18 years old; or up to 21 years if receiving full-time education. | Social Security card or birth certificate of deceased Insured Person. |

| PARENTS, qualified only if the deceased Insured Person has no widow/widower or children, must: – Have a Declaration signed by a Justice of the Peace declaring that there are no surviving beneficiaries; and – Declare that parent(s) were mainly maintained by the deceased Insured Person. – Must be 55 years or over. | When spouse is applying, present marriage certificate or valid declaration to prove common-law union. |

| An overall of 500 contributions is required for a Survivors Pension to be paid. | Must provide proof or a copy of bank/credit union account information. Claim should be submitted within 13 weeks after date of death of Insured Person. |

| If the contribution requirement is not met to qualify for a Pension, a one-time Survivor’s Grant is paid. | If claim is not submitted within the 13 weeks a good reason must be given by the claimant |

| A minimum of 26 paid contributions is required for a Survivor’s Grant to be paid. | No sum shall be paid for any period more than 26 weeks, from date on which the claim was made |

FORM: Click to download forms: SVB1 Form

RATE AND PAYMENT OF BENEFIT

Formula:

Sum of insurable earnings in best 3 years of contributions ÷ 150 x 30% = weekly pension; or If less than 500 paid or credited contributions, 25% of Average Weekly Insurable Earning

INDIVIDUAL PORTIONS

• widow/widower: 66.67%

• invalid children: 40%

• other children: 25%

• parent: 40%

If maximum benefit (100%) is exceeded, each share is reduced accordingly

Minimum Pension is

$47.00 per week

Widow(er) benefit

stops upon remarriage

Benefit for children

(not invalid), continues up to 18 years or if receiving full-time education up to 21 years

As of date of death

of insured person, for as long as the surviving beneficiaries continue to meet the qualifying conditions

WIDOW:

• If all qualifying conditions are met, a Widow may be entitled to receive a survivors’ pension for life.

• If all qualifying conditions are NOT met, a Widow may only be entitled to receive a survivors’ pension for a limited period of time. (Other conditions apply)

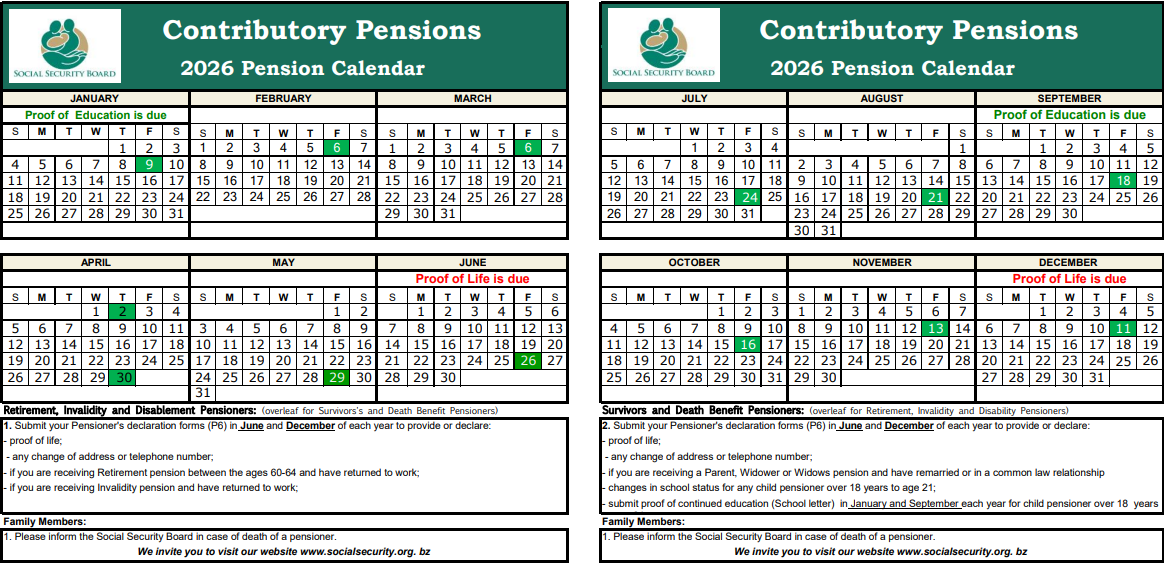

PENSION CALENDAR